Bad Credit Payday Loans Online

Each of us needs emergency funding from time to time in order to cover expenses such as emergency medical treatment, car repairs, urgent purchases, and more. However, you probably understand that it can be quite difficult to find a lender who will lend money to someone with a bad or poor credit history. Is there any way out?

Your best option is a bad credit Payday Loan as it is a simple and safe financing option that can help you meet your payday needs. Moreover, you don’t even need to meet a large number of requirements in order for your application to be approved! Learn the basic information about what is Bad Credit Payday Loan is and make sure that this financial solution meets your wishes and needs.

What is Bad Credit Payday Loan?

A Payday Loan is a simple unsecured type of financing that is designed to enable people with any type of credit to apply and receive financing in an emergency. Note, however, that Payday Loan is a short-term loan so you have to repay the debt with interest on the day of your next paycheck. Also, you don’t even need to provide a deposit in order for your application to be approved! Payday lenders offer both online and offline applications, however, the fastest option for you is the online application.

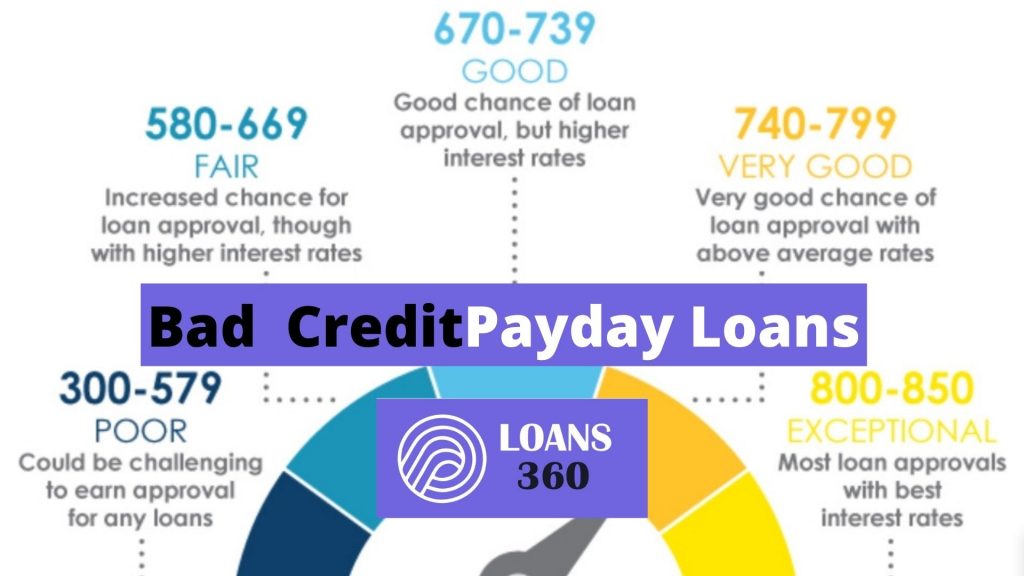

A Payday Loan is also called bad credit Payday Loan because often lenders do not pay attention to your credit score when approving an application. This way, you will be able to get a loan in spite of your previous mistakes.

How do Bad Credit Payday Loans work?

This loan is as easy to use as possible. All you need to do is apply, wait for approval and get funding. Let’s take a look at each point:

- Submit your application. In order to do this, consider the offers of various lenders and choose the most profitable one. Fill out a simple online form and provide the required details such as name, residential address, income, etc.

- Wait for approval. If you meet the basic eligibility criteria, your funding application will be approved almost instantly. The lender will contact you to discuss the terms of the loan and its repayment.

- Get a loan. Once you have signed a loan agreement, you will be able to receive the loan directly into your bank account within one business day.

How much can I get with bad credit Payday Loan

As a rule, payday lenders offer small loans ranging from $ 100 to $ 1000 so that you can cover your urgent expenses. However, pay attention to state laws as the loan amount may vary.

Since this loan is short-term, lenders usually offer small loans ranging from $ 100 to $ 1000, which is often enough to cover the needs. However, before you apply, pay attention to the state laws that most often limit the amount of the loan you can get. For example, in California the maximum loan is $ 255.

Bad Credit Payday Loan FAQ

Can I get a Bad Credit Guaranteed Payday Loan?

No, as no lender provides guaranteed loans. In order to receive any loan, you must meet certain eligibility criteria, which is why the Guaranteed Payday Loan is a myth.

What are the eligibility criteria for obtaining a Bad Credit Payday Loan?

Bad Credit Payday Loan has a minimum amount of requirements. You must be a US citizen or official resident who is at least 18 years old. You must also have a regular monthly source of income and provide an active bank account and proof of identity.

Can I get a Bad Credit Payday Loan from a direct lender?

Yes, it is often the direct lenders that offer Payday Loans, so you can find the one that suits you. It is recommended to contact the online lender as they do not transfer your data to third parties.

References:

https://www.usa.gov/credit-reports

https://www.consumer.ftc.gov/articles/free-credit-reports