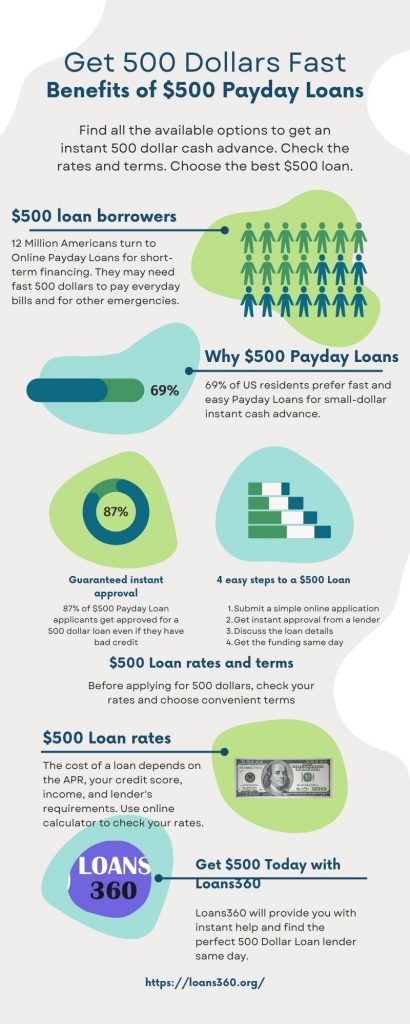

Since most banks and credit unions do not provide such small loans, many people do not know where to get financing, but online lender will approve your application almost instantly!

I need 500 Dollars Loan

Yesterday I came to my friend and told him that this month turned out to be just awful: the car broke down, the child got sick and there was not even money to pay utility bills. I said that I was desperate because I had a bad credit history and no lender could provide me with a $ 500 loan to cope with the difficulties. “Why do you say that?” she asked me, “you can apply for a Payday Loan and solve all your problems!”

Payday Loan? What is it? And does it can really help a person with any type of credit? Let’s figure it out together.

What is a $ 500 Payday Loan?

Payday Loan is not only a simple but also a secure type of financing that allows people with any type of credit to apply and receive financing as quickly as possible. This loan is short-term so it must be repaid with interest on the day of your next paycheck (often within 14-21 days). Since the loan is unsecured, no collateral is required.

$ 500 Payday Loan is a great solution if you are facing financial difficulties and do not have time to look for money. Applications are approved almost instantly!

What are the eligibility criteria for a $ 500 Loan?

Since this loan was created so that the borrower can receive the fastest possible financing in an emergency, it has a minimum number of requirements. However, you should still study them and make sure you comply with:

- Be a US citizen or official resident

- Be 18 years of age or older

- Have a regular monthly source of income of at least $ 1000 after taxes

- Have an active bank account for the deposit

- Have a government issued ID

- Provide contact details such as phone and email

- Provide social security number

Also, remember that eligibility criteria may vary depending on the lender and state of residence. Please note that Payday Loans are prohibited in some states.

How much does a Fast $ 500 Loan cost?

A Payday Loan is a rather expensive type of financing as you do not need to provide collateral and have a good or excellent credit history. To compensate for their risks, payday lenders have fairly high fees that range from $ 15 to $ 30 for every $ 100. Below you can see examples of the loan amount with interest if you receive $ 15, $ 20 and $ 30 fees:

| Loan amount, $ | Fee, $ | Total Fee amount, $ | Total debt, $ |

| 500 | 15 | 60 | 460 |

| 500 | 20 | 80 | 480 |

| 500 | 30 | 120 | 520 |

Thus, a $ 500 Payday Loan can cost you from $ 460 to $ 520.

Where can I borrow 500 Dollars?

Many people who find themselves in difficult life situations do not know where they can get funding to cope with their needs. Often, banks and credit unions only approve applications for people with good or excellent credit. Moreover, the bank can approve a loan for up to a week!

However, if you need financing as quickly as possible, you can choose an online lender and submit a simple and convenient online application. The money will be transferred directly to your bank account!

Compare to the other Online Payday Loan amounts available

$100 Loan

$200 Loan

$300 Loan

$400 Loan

$600 Loan

$700 Loan

$800 Loan

$900 Loan

$1,000 Loan

What can I spend my $ 500 Payday Loan on?

Initially, a Payday Loan was created so that almost any borrower can apply and cover all their personal needs. However, most Americans are now applying to cover their basic needs.

Despite the fact that the payday lenders have no restrictions on how you can spend the money on, below you can study the list of the main things people want to get a loan for:

- Utility bills

- Renting a house or apartment

- Medical treatment or pills

- Car or home repair

- Urgent purchase

- Other emergencies

In other words, it doesn’t matter if a similar situation happened to you or you need money for other needs, a $ 500 Loan would be a great option in any case.

How does 500 Dollar Cash Advance work?

If you need emergency financing, then Payday Loan is the ideal option as the entire process from applying to obtaining a loan is fully available online. Learn 4 basic steps to get your $ 500 Payday Loan as fast as possible:

| 1. Choose a lender | Before submitting an application, you should study the offers of different lenders and choose the one that suits your wishes and needs. When choosing, pay attention to interest rates and credit conditions. |

| 2. Apply | Once you have selected a lender, visit their website and fill out a simple online form. You will need to provide your name, residential address, income information, and more. Do not worry as the application will not take you more than 5-10 minutes. |

| 3. Wait for approval | If you meet the basic requirements of the lender, then you will not have to wait long as your application will be approved almost instantly! The lender will contact you by phone to discuss the terms of the loan. |

| 4. Get your money | Study a loan agreement carefully and sign it if it suits you. The loan amount will be transferred to your bank account within one business day. |

How can I get a $ 500 Loan from a direct lender?

Often, it is the direct online lenders that provide such loans, so it will not be difficult for you to get financing.

Working with a direct lender, you do not have to overpay to third parties for their services and also wait for their approval. Moreover, loans from direct lenders are safer as they do not share your data with third parties.