Long-term personal loans help in situations when unexpected expenses or a financial crisis appear in our budget. It is not uncommon for borrowers to ask the following questions: How to apply online? Where are long-term loans granted? In the face of financial problems, when we urgently need financial resources, we do not have time to learn about the opportunities, offers or risks associated with taking out a loan. Therefore, read the answers to these questions now!

What are $2,500 personal loans?

Online loans are gaining more and more recognition among consumers. No wonder new offers appear on the market every day, which guarantee us quick access to the money we need. Initially, most offers concerning payday loans, i.e. short-term liabilities. However, nowadays we can also find various offers of financial support with a long loan period without any problems. One of them is a personal loan for up to 60 months. Thanks to them, we receive the possibility of returning the amount due in installments according to a predetermined schedule. Unlike payday loans, the loan time, in this case, is much more than 30 days. Depending on the company we choose, we can apply for the repayment spread over up to 60 monthly installments. However, interest, commission, and other fees should be added to the final repayment costs. We should also remember about the dependence that the longer the loan period, the higher the costs.

For whom a $2,500 personal loan will be a good solution?

$2,500 personal loans will be a good solution for people who need more financial support. Loan companies guarantee smoother scoring. Therefore, if our application has been rejected by the bank, we still have a chance for a positive decision from a non-bank lender. It is also a great solution for people who are not sure that they will be able to pay off their obligations in the short-term characteristic of payday loans. If we have problems with the repayment of existing obligations, a long-term $2500 loan can be used for consolidation.

Advantages of $2,500 personal loans

Why are long-term $2,500 loans a good solution? Here are the most important advantages of this offer.

- the possibility of submitting an application via the Internet;

- mild scoring, less demanding loan terms;

- formalities kept to a minimum;

- flexible installments;

- the possibility of consolidating liabilities;

- short waiting time for a loan decision;

- quick transfer of $2500.

How to apply for 2500 loans online?

Online loans provide us with 24/7 access to application forms. We can arrange all formalities at any place and time. How to do it?

- If you have already chosen the offer that interests you, just go to the lender’s website.

- Next, we must use the sliders to determine the loan amount of $2500 and the loan period.

- After reviewing the costs of the commitment, you can proceed to fill in the form. For this purpose, you will need personal, contact and address details as well as information about expenses and income.

- Once you have provided all the necessary information and consent, you can proceed to the final stage, which is identity verification.

- After successfully passing the identification stage, it is the lender’s turn to analyze your application, and then, within a few minutes, will issue a decision on whether to accept or reject our application. In the event of a positive decision, we can count on the payment of money within a maximum of 24 hours.

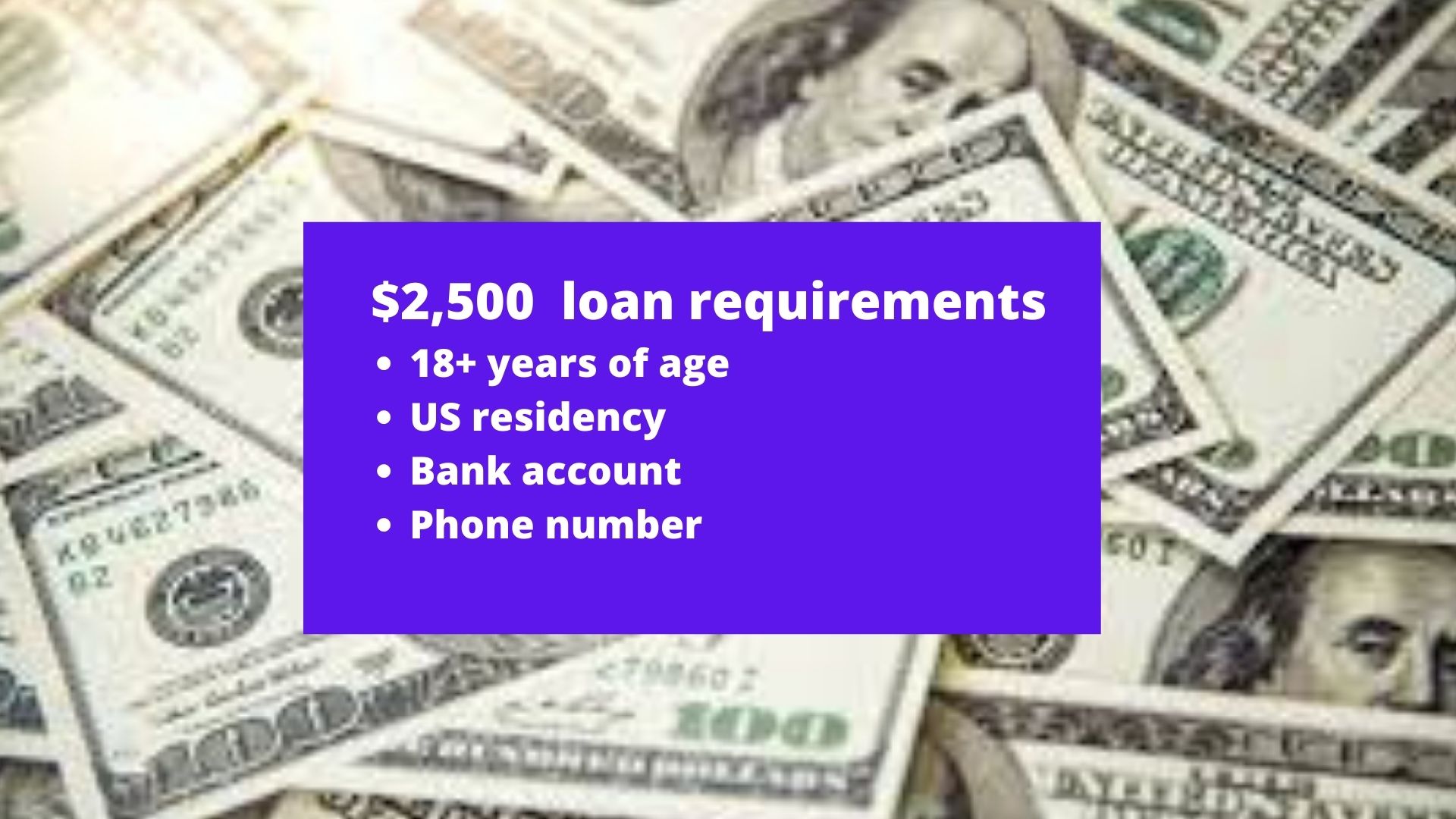

What conditions must be met when applying for 2500 personal loans?

Most lenders offer personal loans without income certificates. This means that we do not have to confirm our income with additional documents. In addition, the source of income in the form of a mandate contract or a specific task contract is not a problem.

- appropriate age – you should also meet the appropriate age criteria set by each creditor individually. The minimum age can be 18, 20 or even 25 years old.

- having U.S. citizenship and permanent residence in our country. The confirmation of this information will be a valid ID card.

- an active bank account that we will use to collect the loan, as well as for identity verification purposes.

- active phone number and e-mail address.

What income is accepted when applying for $2 500 personal loans?

Some lenders may require us to confirm the income they receive, but not everywhere will be an employment contract. At some stage of completing the application, we will be asked to provide the number of earnings and their source. Depending on the company we use, the following will be accepted:

- contract of employment;

- contract of mandate;

- own business;

- contract work;

- pension;

- maintenance.

Less and less often, lenders also ask for bank statements.

Are 2500 personal loans for bad credit possible?

Financial support, known as a $2500 personal loan for bad credit, is also very popular. This is an alternative for people who do not meet the banking requirements, and at the same time want a larger amount of the liability and spread it into installments. Let’s start with a reminder of what the debtor databases are. Debtor databases collect information on our current and past loans and credits, which they make available to both banking and non-banking institutions. There you can find entries on timely repayments, but also information on delays in reimbursement.

Each loan company verifies our data in the debtor database. However, some emphasize that its result does not prejudge the decision made. Even people with a bad credit history can get financial support. In such situations, a documented permanent source of income usually speaks in favor of granting a loan. It happens that even without certificates, you can get a positive credit decision.

How do 2500 personal loans work?

Companies offering their services online emphasize that the most important thing for them is the customer. Therefore, they try to make their products available to all interested persons as much as possible. Personal loans are also characterized by reducing all formalities to a minimum, which allows shortening the application time, but also affects the greater granting of loans. Loan companies that offer loans for longer periods secure themselves in a different way. Some of them consider the result of credit history verification in debtors’ databases as the main criterion when making decisions. Lenders will also require us to go through the above-mentioned verification process.

In order for the entire lending process to run smoothly, you should prepare in advance:

- bank account number – will be used for a verification transfer, and then we will receive a loan on the same account;

- ID card – needed to enter the appropriate data in the fields of the form;

- mobile phone number – by phone you will receive information about the acceptance or rejection of the request.

Are $2,500 personal loans with bad credit for everyone?

It is worth noting that not everyone will have a chance to accept the application. Personal loans for indebted people are intended for people who have a problem with settling their current liabilities. Some lenders also accept applications from people against whom debt collection proceedings are pending – these are the so-called loans with a bailiff.

However, it should be noted that people whose income or property has been seized by a bailiff may not find help also in the case of loan companies. It is worth emphasizing that no institution will provide financial support to a person who will not be able to pay it back.

FAQ

What can I use 2500$ personal loans for?

Bad credit personal loans can be used for any purpose. The loan decision is independent of what we finance from the money received. These can be medical bills, a dream trip, a new car, or renovation. Everyone can decide for themselves what to spend their money on and no one will require us to provide a reason for taking a loan.

Will I need certificates when applying for personal loans?

Lenders keep all formalities to a minimum. We will not need certificates from the workplace or other documents confirming the income received. To get a loan, we only need a valid ID card and a completed application.

How long does it take to transfer a 2500 loan?

The waiting time for the transfer depends on the bank session. If the lender sends money by traditional transfer, the waiting time for the transfer may be extended up to 24 hours. Therefore, it is worth checking in which bank the lender has a registered account. Some lenders are also introducing an express transfer system. In such a situation, the only limitation will be the lender’s working hours.