Most often, it is direct lenders who provide installment loans, so it will not be difficult for you to obtain financing without third parties. A loan from a direct lender is approved faster and costs less.

Guaranteed Installment Loan for bad credit direct lender

Each of us needs additional funding from time to time in order to cope with our needs. This could include car repairs, urgent purchases, medical treatment, wedding expenses, and more. However, most Americans do not have emergency savings to cope with these expenses so they have to look for the type of funding that suits their needs. However, is it possible to find an advantageous loan offer with a bad credit history?

Bad Credit Online Installment Loans are a great option for you, since you can get a fairly large loan amount and you do not have to think about how to cover it with one salary. Moreover, some installment lenders approve loans even for bad credit!

Installment Loan: What You Should Know

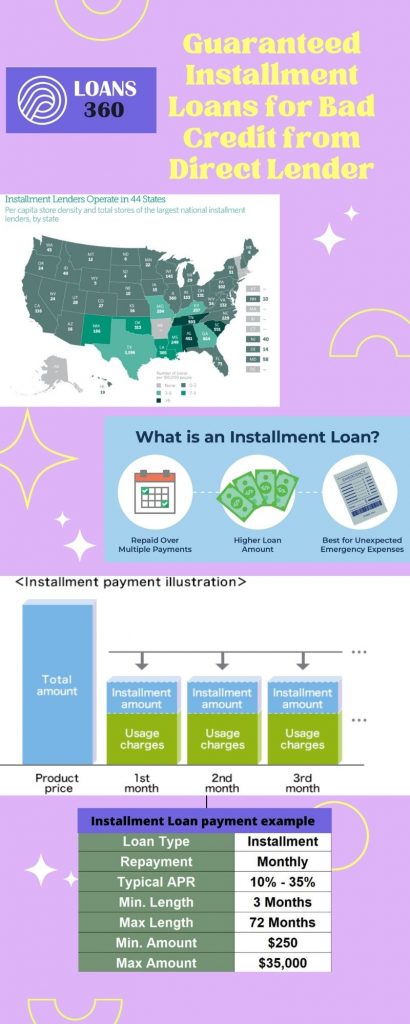

An Installment Loan is a simple type of financing that helps borrowers obtain financing in order to meet their needs. This loan is paid in regular monthly installments over a fixed period of time until the debt is fully repaid. An Installment Loan can be either secured or unsecured depending on the type of loan you need to cover your needs. This type of financing is also popular since you do not need to pay off the debt from one paycheck as in the case of a Payday Loan.

How can I get a Guaranteed Installment Loan?

The first thing you need to know if you want to get an Installment Loan is that there is no guaranteed approval. Each lender, including the installment lender, has his own eligibility criteria that must be met in order for your application for financing to be approved. Thus, no lender provides a guaranteed approval as it is too risky for them.

If you see offers on the Internet for a Guaranteed Installment Loan no matter what, most likely you are dealing with scammers.

Can I get a Guaranteed Installment Loan with bad credit?

Often, lenders check credit history in order to decide whether to provide you with a loan or not. Some installment lenders approve applications even for people with bad credit, but it is important to understand that you will receive a less favorable loan offer and higher interest rates than a borrower with good or excellent credit.

Why choose a Guaranteed Installment Loan from a direct lender?

If you want to get an Installment Loan to cover your needs, then a direct lender will be the best option for you. First, the direct lender will approve your application much faster, since you do not have to deal with intermediaries and wait for their approval. Also, a loan from a direct lender is cheaper as you do not need to pay third parties for their services.

Moreover, working with third parties is unsafe as they may transfer your personal data. If you choose a direct lender, then all your data will be safe.

How does a Guaranteed Installment Loan work?

Now getting a loan has become as easy as possible as lenders offer full online financing. Thus, you do not have to waste time looking for a lender near you!

- Application. Before submitting an application, study the offers of different lenders and choose the one that suits your wishes and needs. Compare interest rates and credit conditions. Once you have selected a lender, visit his website and fill out a simple and secure online form. You will need to provide name, contact information, income, residential address, and more. After making sure that all the data has been entered correctly, send an application.

- Approval. Often, installment lenders respond to the application on the same day as the borrower submits it. If you meet the basic eligibility criteria, your application will be approved within an hour. The lender will contact you by phone to discuss the terms of the loan and its repayment.

- Financing. Study a loan agreement carefully before signing it. The money will be transferred to your bank account within one business day.

What are the eligibility criteria for a direct lender Guaranteed Loan?

As you know, each lender has different eligibility criteria that must be met in order for your funding application to be approved. As a rule, installment lenders do not have a large number of eligibility criteria that must be met, but you should pay attention to the main ones:

- Be a US citizen or official resident

- Be at least 18 years of age or older

- Have a regular monthly source of income

- Have an active bank account

- Provide government issued ID

- Provide Social Security Number

- Provide contact details such as phone and email

Also remember that eligibility criteria may vary depending on state laws so check it before applying for an Installment Loan.

Guaranteed Installment Loan bad credit direct lender FAQ

Can I get a guaranteed Installment Loan for bad credit?

Unfortunately no. No lender provides guaranteed loans as they must assess the risks. However, if you meet the basic requirements your chances are good enough.

How can I get a Guaranteed Installment Loan near me?

You no longer need to look for an installment lender as now most lenders offer an online application. It is not only convenient, but also fast as the money will be transferred to your bank account the very next business day!

Is it safe to apply for an Online Guaranteed Installment Loan from a direct lender?

Yes, the whole process from submitting an application to receiving funding is absolutely safe, since all your data is encrypted and is not transferred to third parties.

References:

https://iclg.com/practice-areas/lending-and-secured-finance-laws-and-regulations/usa